Payment reductions. That’s what is in the Fiscal Year 2022 SNF PPS Proposed Rule. Payment reductions.

FY 2023 Proposed Updates to the SNF Payment Rates

CMS estimates that the aggregate impact of the payment policies in this proposed rule would result in a decrease of approximately $320 million in Medicare Part A payments to SNFs in FY 2023 compared to FY 2022. This estimate reflects a $1.4 billion increase from the 3.9% update to the payment rates, which is based on a 2.8% SNF market basket update plus a 1.5 percentage point market basket forecast error adjustment and less than a 0.4 percentage point productivity adjustment, as well as a 4.6% decrease in the SNF PPS rates as a result of the proposed recalibrated parity adjustment. These impact figures do not incorporate the SNF VBP reductions for certain SNFs that are estimated to be $186 million in FY 2023.

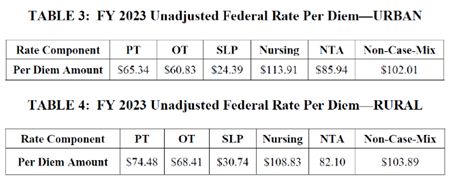

Updated Base Rates

Tables 3 and 4 reflect the proposed updated unadjusted federal rates for FY 2023, prior to adjustment for case-mix. (Note that these two tables do not reflect the parity adjustment.)

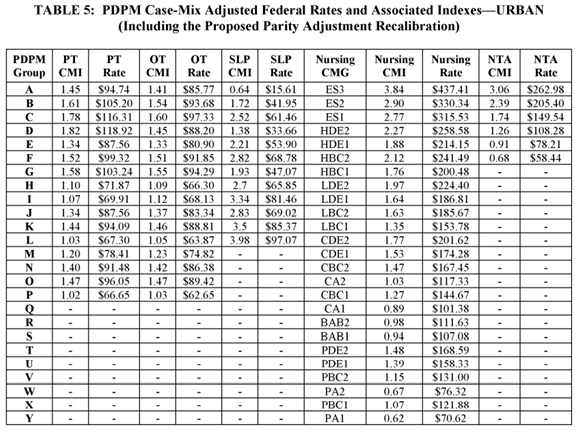

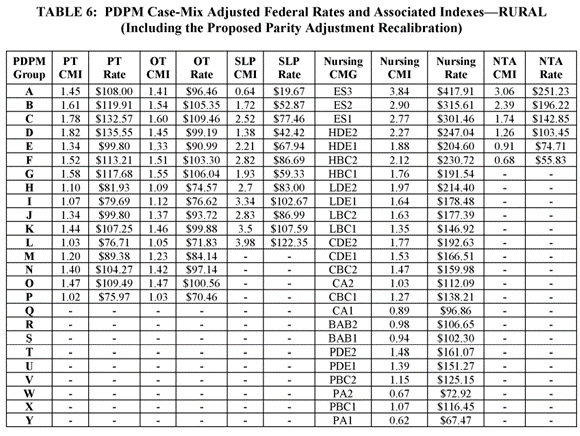

Proposed Recalibration of the PDPM Parity Adjustment

Since PDPM implementation, CMS’ data analysis has shown an unintended increase in payments of approximately 5%, or $1.7 billion in FY 2020. CMS has conducted the data analysis to recalibrate the parity adjustment in order to achieve budget neutrality under PDPM. CMS acknowledges that the COVID-19 PHE could have affected the data used to perform these analyses. CMS did not propose recalibrating the PDPM parity adjustment in the FY 2022 SNF PPS proposed rule, but instead asked for stakeholder comments on the parity adjustment and a potential methodology to account for the effects of the COVID-19 PHE without compromising the accuracy of the adjustment. Based off stakeholder feedback, CMS is proposing a recalibration of the PDPM parity adjustment using a combined methodology of a subset population that excludes those patients whose stays utilized a COVID-19 PHE-related waiver or who were diagnosed with COVID-19, and control period data using months with low COVID-19 prevalence from FY 2020 and FY 2021. As a result of this methodology, CMS is proposing a parity adjustment that would reduce SNF spending by 4.6%, or $1.7 billion, in FY 2023.

Considering we are still in a Public Health Emergency, these cuts are not the best of timing. We are hopeful that CMS will realize that PDPM is doing EXACTLY what it was intended to do: capture each resident’s individual clinical characteristics, and payment is reflective of those characteristics and the resources needed to provide care to Medicare Part A beneficiaries. Finally…we are seeing that payment is in alignment with care, but CMS did not anticipate that capturing Speech-Language Pathology (SLP) clinical characteristics, Nursing, and Non-Therapy Ancillaries would increase Medicare payments. One would think that if, under RUGS, SLP clinical characteristics, Nursing, and Non-Therapy Ancillaries were not part of the RUG payment calculation, adding these components would increase payment under PDPM, right?…right. And now, providers are once again facing more payment cuts. If this does not impact patient care access in Post-Acute Care, I do not know what does. After all, not everyone will be well enough or even safe enough to return home after an acute hospital stay. If you continue cutting the SNF sector, you will close SNF doors just in time for the baby- boomer surge.

Source Documents:

Fiscal Year (FY) 2023 Skilled Nursing Facility Prospective Payment System Proposed Rule (CMS 1765-P) | CMS; Federal Register :: Medicare Program; Prospective Payment System and Consolidated Billing for Skilled Nursing Facilities; Updates to the Quality Reporting Program and Value-Based Purchasing Program for Federal Fiscal Year 2023; Request for Information on Revising the Requirements for Long-Term Care Facilities To Establish Mandatory Minimum Staffing Levels